Bank Reconciliation in SAP S/4 HANA

- Musaif Ahmad

- May 9, 2024

- 2 min read

Updated: May 23, 2024

Manual Bank Reconciliation in SAP

Manual bank statement reconciliation involves selecting bank statement lines and system transactions to be reconciled together. During reconciliation if a system transaction hasn't been cleared the reconciliation process clears the transaction first, and then reconciles it.

1:-House Banks (Fi12)

Click on position and Enter Your company Code

Select Your company code and Click on House Banks

Select house bank and click on bank account.

Bank Account details

2:-Create GLs

· Main bank Account

· Incoming Account

· Outgoing

Account Control data tab, Account management right tick Open Item management.

Field status group G001 General and save

3:- Create and Assign Business Transaction (OT52)

In this step you store an indicator for each business transaction and allocate a posting rule to each business transaction. Several business transactions usually refer to the same posting rule.

Example:- To differentiate business transaction, you assign to the “Credit memo, domestic” transaction an indicator different from the one for “credit memo, foreign” or” credit memo, rent”. Since posting is the same for these transactions, you can allocate all three to one posting rule (credit memo).

4:- Define posting keys and posting rules for manual bank statement

Path:-Simg, Financial Accounting, Bank Accounting, Business Transactions, Payment Transactions, Manual Bank Statement, Define Posting Keys and Posting Rules for Manual Bank Statement.

Enter your Chart Of Account

Create Account Symbols

Click on New Entries

Assign Accounts to Account Symbol

Click on New Entries

Create Keys for Posting Rules

Click on New Entries

Define Posting Rules

Click on New Entries

BMW1, Posting key 40, Account DR(bmw4) :-main bank account, Account CR (BMW1) Incoming Receipts

BMW2, Account DR bmw2 Outgoing Receipts, Posting key 50, Account CR bmw4 main bank account.

5:-Define variants for manual bank statement (OT43)

In this step you can create separate account assignment variants for the manual bank statement in order to adapt the arrangement and/or the selection of account assignment fields to your company specific requirement.

One variant is delivered as a default. It connote be modified.

If you do not want to work with the standard variant, you can deactivate. New variants must be activated after you create them.

Activities

1. To create a new variant, choose variant > New variant > Create…

2. In the pop-up window enter the variant ID, description and the number of account assignment lines.

6:-Posted document Display Document (FB03)

Enter document number (incoming)

Enter

Outgoing

Enter

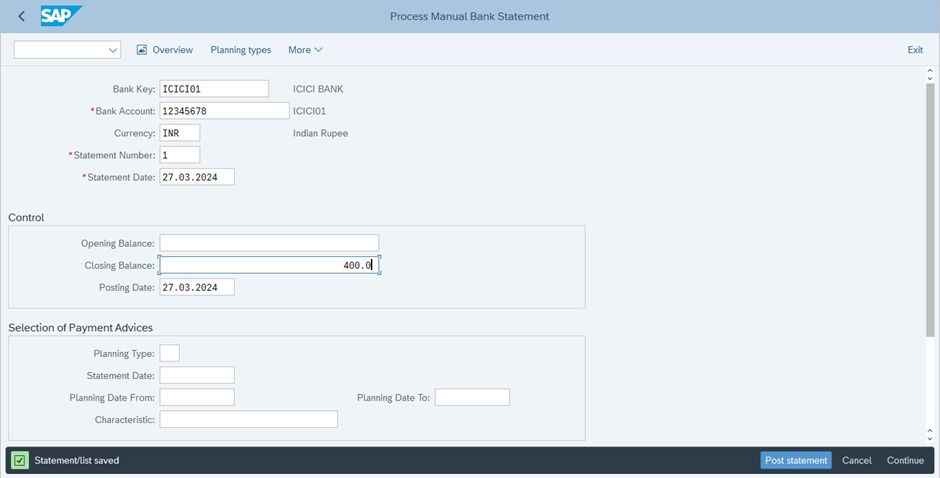

7:-Manual Bank statement (FF67)

Click on Settings enter specification and select your variant.

Add bank details and add closing bank balance and Click on post statement

Statement/list save

Mis match balance

I really enjoyed your post—it highlights the seamless and secure gaming experience well. Fairplay24 truly delivers with intuitive registration, strong security, and a user-friendly design. The Fairplay24 login is especially impressive—fast, reliable, and encrypted for full data protection. Your review perfectly captures that balance of functionality and trust, which makes all the difference for users exploring gaming platforms. Would love to hear how your experience compares!

Team Fairplay24

https://fairplay24.world/

Data Cambodia

Bocoran Sdy

Bocoran Sgp

Bocoran Hk

Syair Sdy

Syair Sgp

Syair Hk

Freebet Gratis

Freebet

Erek Erek

Cara Curang

Cara Menang

Bet Gratis

Deposit Pulsa

Freebet Bola

Freebet Casino

Freebet Poker

Freebet Slot

Freebet Togel

Bet Gratis

Deposit Pulsa

Freebet Bola

Freebet Casino

Freebet Poker

Freebet Slot

Freebet Togel

Bet Gratis

Deposit Pulsa

Freebet Bola

Freebet Casino

Freebet Poker

Freebet Slot

Freebet Togel

Bet Gratis

Deposit Pulsa

Freebet Bola

Freebet Casino

Freebet Poker

Freebet Slot

Freebet Togel

Buku Mimpi 2D

Erek Erek 2D

Erek Erek 3D

Erek Erek 4D

Shio Togel

HI BEST PUNE // HI REAL CITY PUNE // HI GREAT CITY IN PUNE // HI AIRPORTS PUNE //

HI BN PUNE // HI PUNE ESCORTS // HI HOTEL IN PUNE // HI BEST CITY IN PUNE //

HI PIMPRI PUNE // HI KOREGAON PARK // HI HINJEWADI PUNE // HI DECCAN PUNE //

HI BALEWADI PUNE // HI BANER PUNE // HI WAKAD PUNE // HI VIMAN NAGAR PUNE //

HI SHIVAJI NAGAR PUNE // HI RAVET PUNE // HI city PUNE // HI CITY IN PUNE ///

HI PUNE GREAT CITY // HI LOVELY DESIRE // Best In Pune // the royel city pune

Manual bank reconciliation in SAP involves matching bank statement lines with system transactions. The process begins with selecting house banks (using FI12) and managing accounts, including creating GLs for main, incoming, and outgoing accounts. This setup ensures proper accounting controls, such as enabling open item management.

To create and assign business transactions (OT52), you need to store indicators and allocate posting rules for different transaction types. For example, various credit memos can share the same posting rule while being distinguished by their indicators.

Unlock your success: https://www.examsvce.com/CIFC-exam.html

Defining posting keys and posting rules for manual bank statements is crucial for accurate financial reporting. You can set this up by navigating through the SAP paths to create account symbols and posting…

Recently, I got the opportunity to use the services of Best Online Exam Help, and I should say, that I am quite impressed. I was studying Bank Reconciliation in SAP S/4 HANA and had some tough exam questions that needed expert guidance. Best Online Exam Help provided detailed solutions and explanations that helped me understand the complex concepts. Their team was quite responsive, supportive, and efficient in addressing my queries.